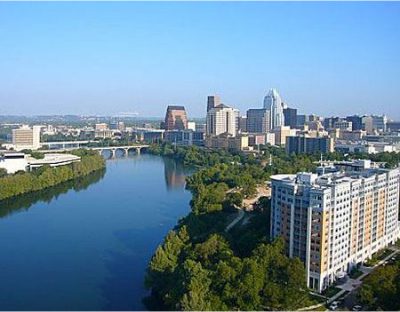

Austin, Texas – the state’s capital – is a fast growing college town and home to white-collar Texans. Surrounded by two of the fastest moving Texas towns, Austin is a great place to invest in. Austin has seen more than plenty of growth and development over the past five years, and new jobs continue to open up in the town conveniently located between the major Texas business hubs: Dallas, San Antonio, San Marcos, and Schertz. Perhaps best of all is the home market in Austin. Property values and prices are very stable, especially compared with major cities in the rest of the country. As a result, there are a number of opportunities involving commercial loans in Austin.

More and more Texans are starting to realize that while most of the country is struggling economically, companies are looking for a cheaper place to do business and finding it in Austin. The state of Texas has been offering business tax incentives and other bonuses to companies to encourage this migration. The fact is, Texas has had more growth and jobs relocate here than any other state in America.

FREE CONSULTATION • FREE APPRAISAL • 877-251-4598

GET A FREE CONSULTATION TODAY!

Fill out the form below today and we'll call you back to discuss your commercial loan scenario.