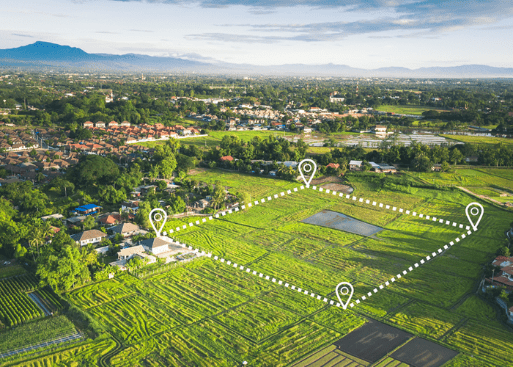

Investing in land can be an enticing opportunity for those looking to secure a piece of property for future use or development. However, the decision to purchase land with Land Loans in San Antonio requires careful consideration of several factors to determine whether it’s a sound investment.

Assessing the Investment Potential

- Long-Term Value: Land is typically considered a long-term investment. Its value may appreciate over time, especially if located in a desirable area poised for development or growth.

- Development Potential: Buying land with loan financing can be profitable if there’s potential for future development or rezoning, increasing its value significantly.

- Risks and Challenges: Land investments can also be risky, especially if the market conditions or local regulations change unexpectedly, affecting the land’s value and potential use.

Financing Considerations

- Loan Terms: When considering a land loan, examine the interest rates, repayment terms, and associated fees carefully. Ensure the loan structure aligns with your investment goals.

- Financial Stability: Evaluate your financial stability and ability to manage loan payments. A well-planned investment strategy and realistic financial projections are crucial.

Assessing Financial Viability

Before committing to a land purchase with a loan, it’s essential to evaluate the financial implications and feasibility of the investment. Several key considerations can help assess the financial viability of purchasing land with loan financing.

Loan Terms and Interest Rates – When securing a land loan, carefully review the terms and conditions lenders offer. Interest rates, loan duration, and repayment schedules can significantly impact the overall cost of financing.

Repayment Plans and Financial Stability – Assessing repayment plans is crucial to ensure the investment aligns with your financial capabilities and goals. Evaluate your financial stability and cash flow projections to determine your ability to meet loan obligations over time.

Importance of Professional Guidance – Navigating the financial aspects of land investments requires expertise and careful planning. Consulting with financial advisors, real estate professionals, and lenders can provide valuable insights and guidance throughout the investment process.

Learn More About Land Loans with Proactive Commercial Lending Group

While buying land with a Land Loan in Houston can offer substantial potential returns, it’s not without risks. Successful land investments often require strategic planning, market knowledge, and financial preparedness.

For tailored financing solutions and expert guidance on land loans, consider partnering with Proactive Commercial Lending Group. With our comprehensive lending services and industry expertise, we can help you navigate the complexities of land investments and secure the right financing for your needs. Contact us today to discuss your investment goals and explore available loan options.

Unlock the potential of land investments with Proactive Commercial Lending Group.